Rebuild. Rebrand. Reignite Growth.

723%

ORGANIC TRAFFIC

44%

ADWORDS SPEND

We helped a UK property firm cut ad spend by 44%, boost ROI to 438%, and drive 723% more organic traffic.

438%

Adwords ROI

Rebuild. Rebrand. Reignite Growth.

We helped a UK property firm cut ad spend by 44%, boost ROI to 438%, and drive 723% more organic traffic.

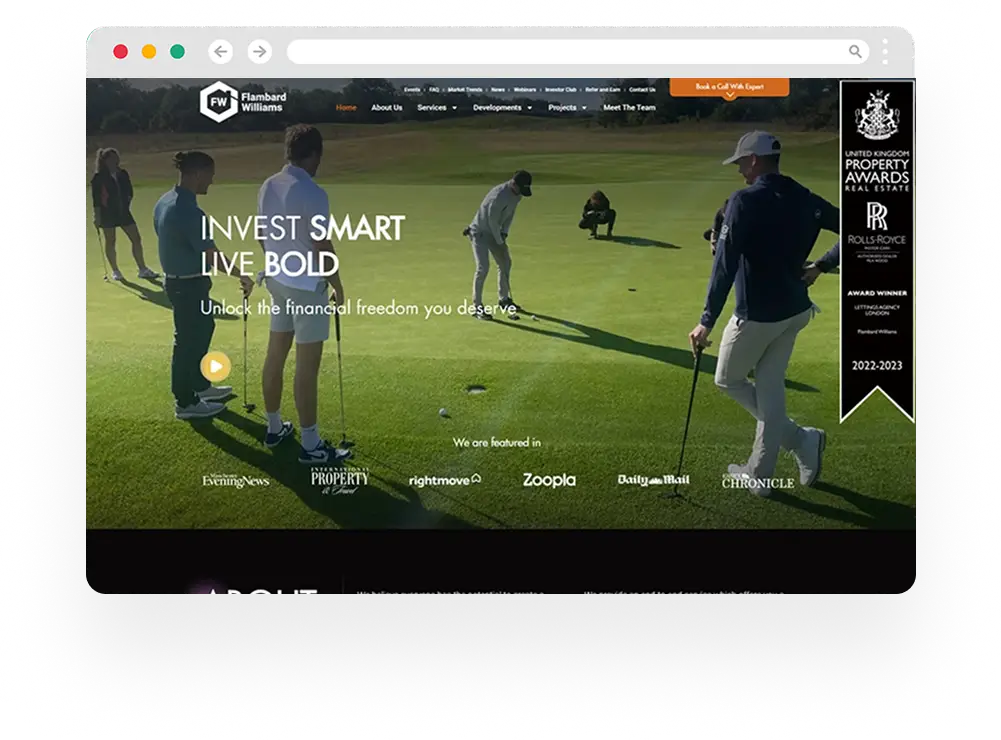

Lead Generating Website Design CASE STUDY

438%

Adwords ROI

44%

Ad spend

723%

Organictraffic

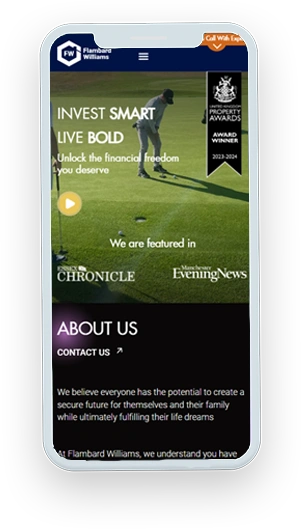

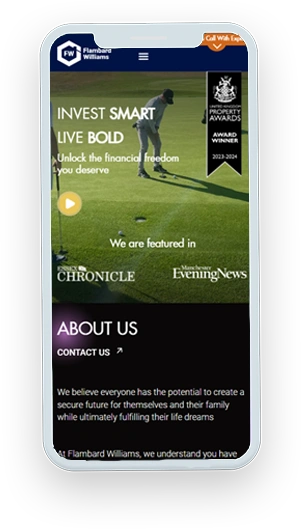

87%

Mobile

Session

Book Your FREE 1-Hour Strategy Call to 2x Your Revenue

Get proven, personalised strategies to double your profits.

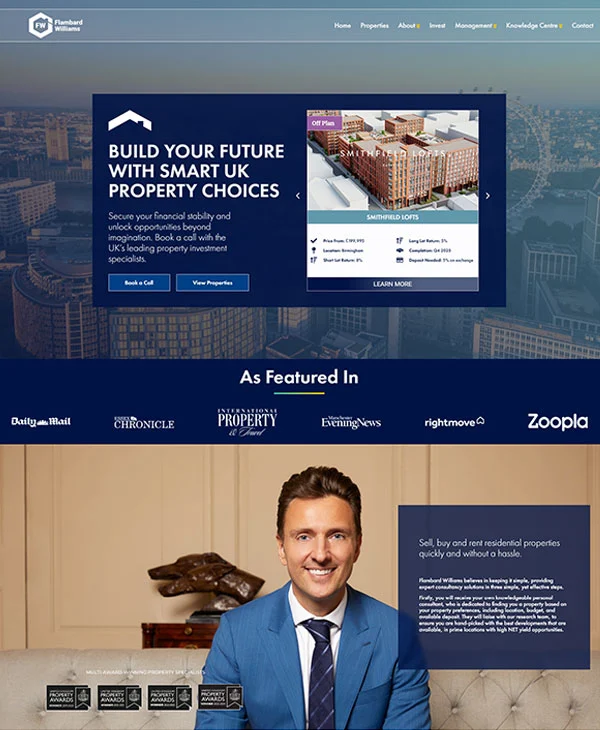

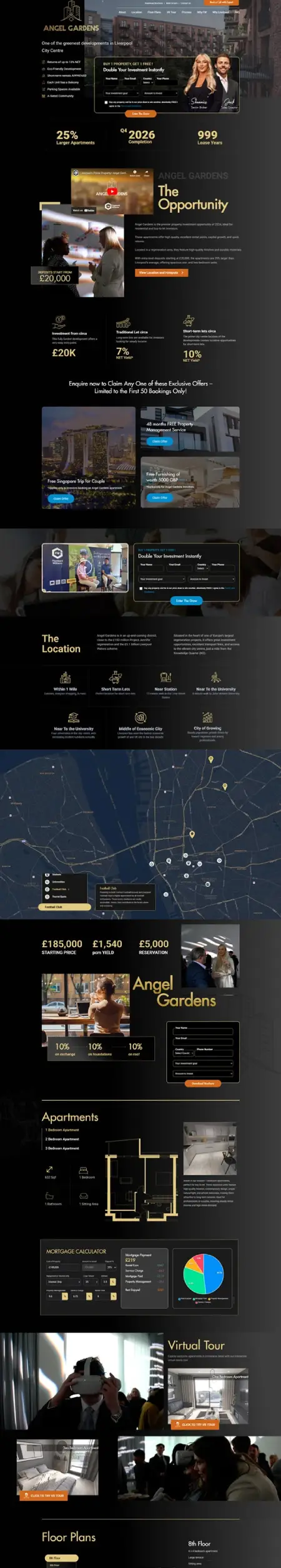

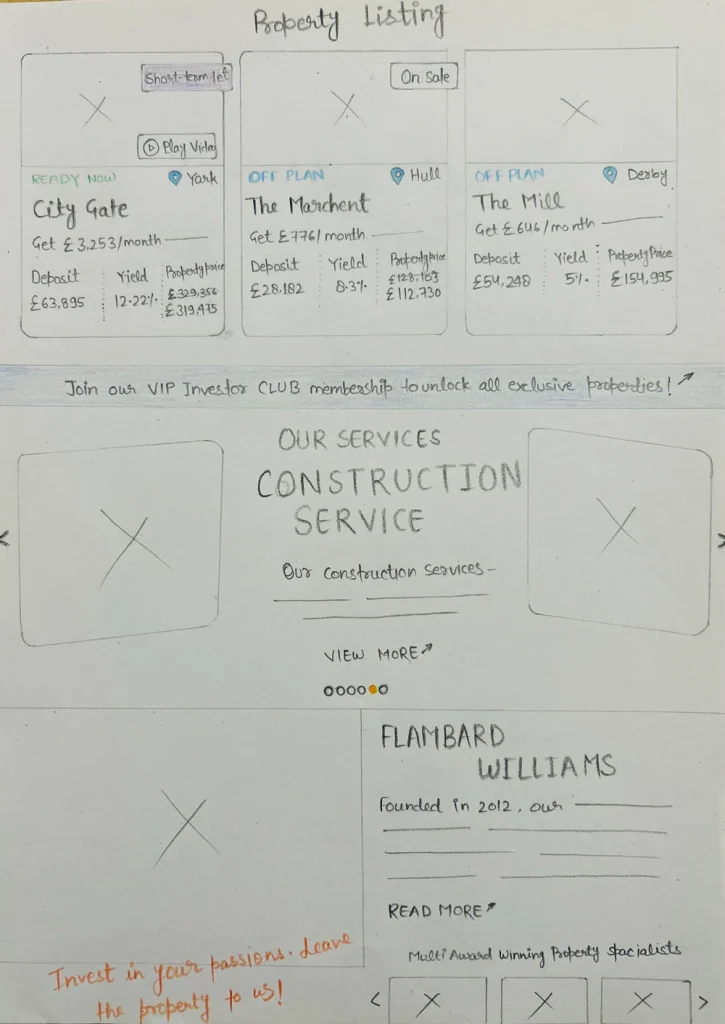

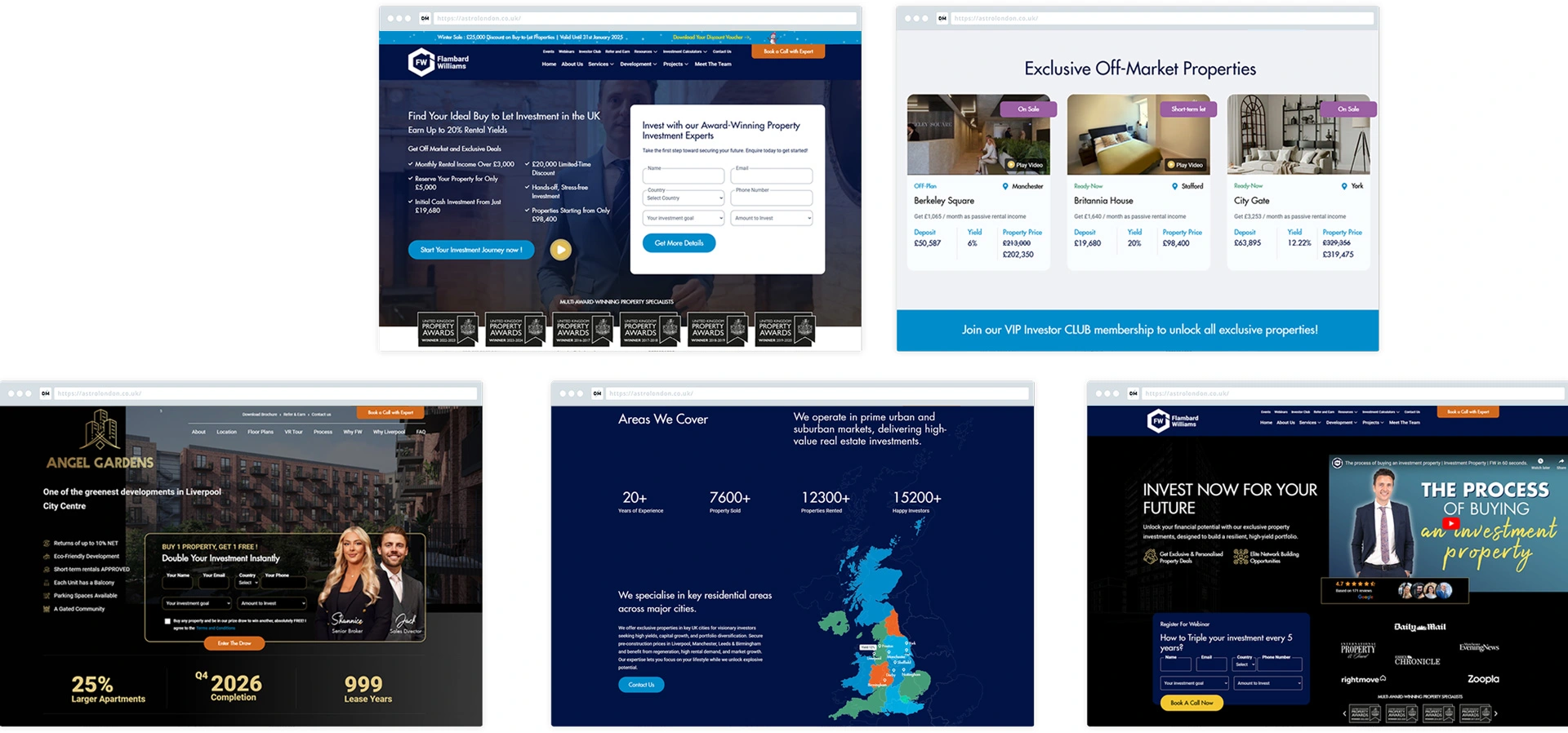

OLD Look

Not Getting

Enough Leeds

Unprofessional

Design

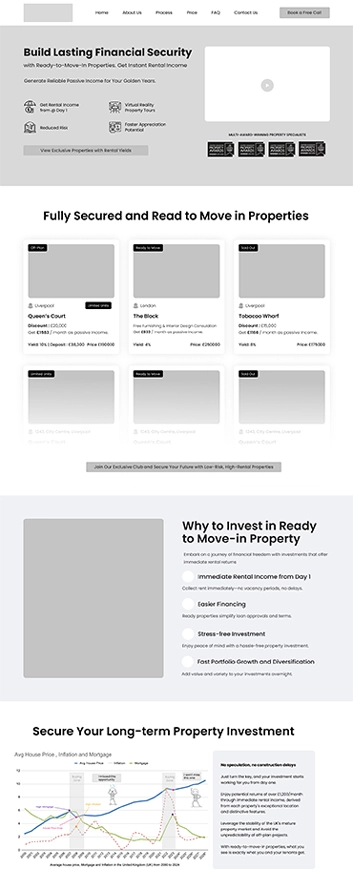

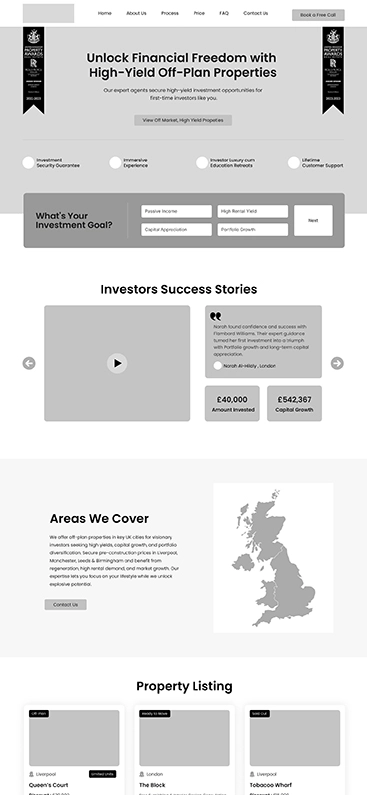

NEW Look

SEARCH ENGINE OPTIMISED COPY

EMOTIONAL TRIGGER

To grab user's attention

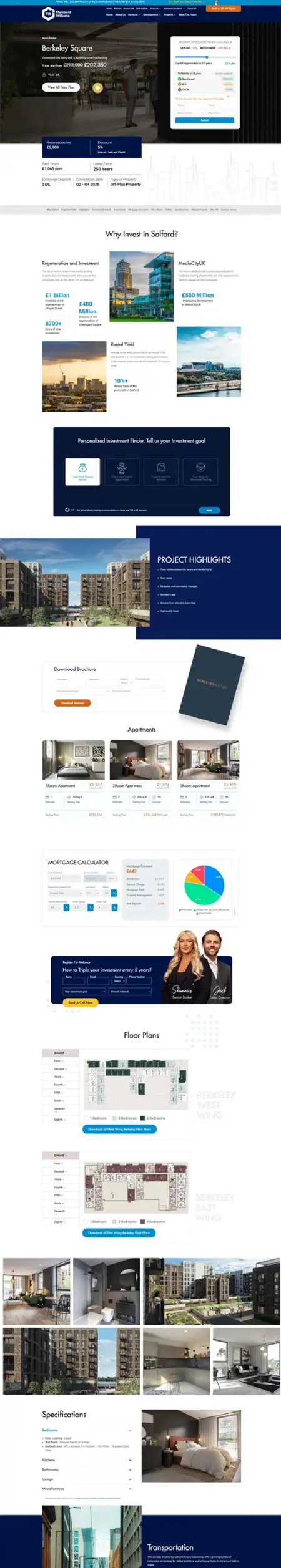

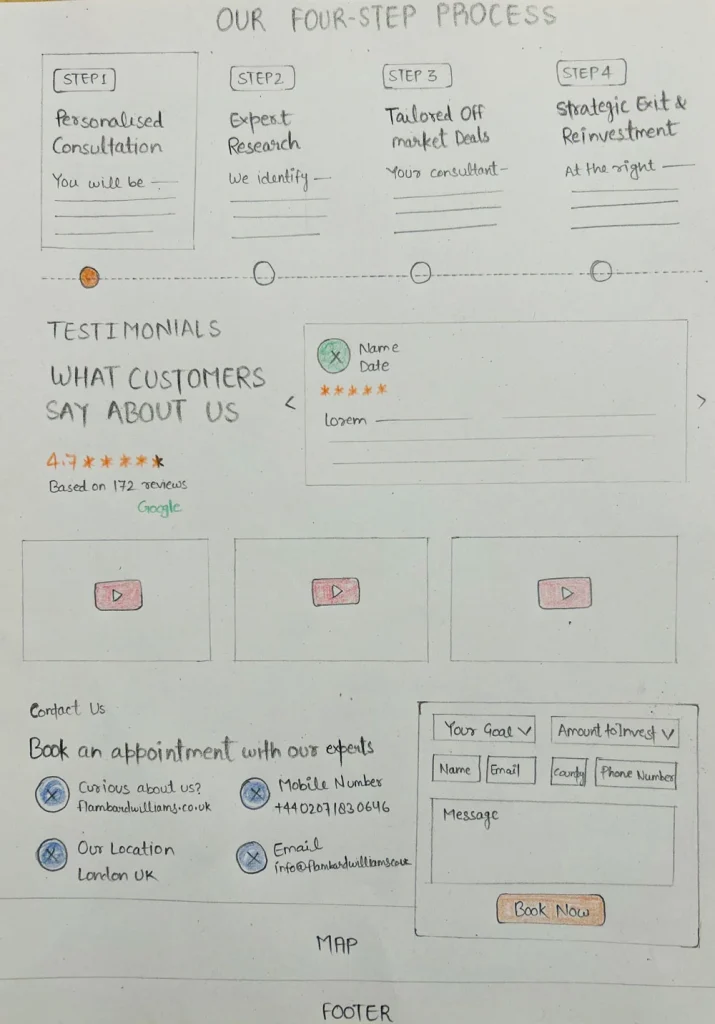

Adwords Result

The cost per client decreased by 43.43%

| Metric | Old Campaign (July 2024) | New Campaign (Oct 2024) | % Change |

|---|---|---|---|

| Valid Leads (%) | 65.5% | 71.8% | ↑ 9.62% |

| Not Answering/Bad Leads (%) | 34.5% | 28.2% | ↓ 18.26% |

| Valid Leads to Conversion (%) | 2.2% | 6.3% | ↑ 186.36% |

| ROI (%) | 204.8% | 438.5% | ↑ 114.13% |

Old Adwords Campaign ROI

204.8%

New Adwords Campaign ROI

438.5%

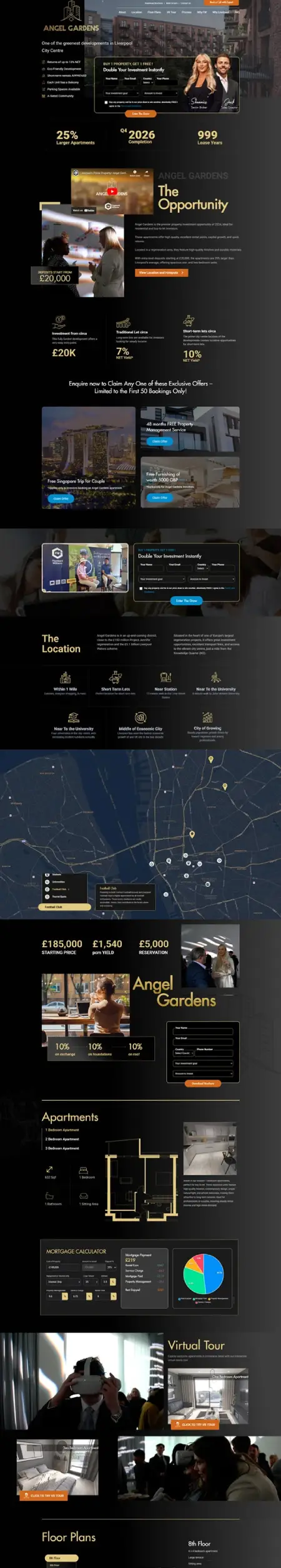

oRGANIC Result

Organic Traffic Improvement after site live – Aug 2024

Events per Session

Engaged Sessions

Key Events

Avg. Engagement Time

Design

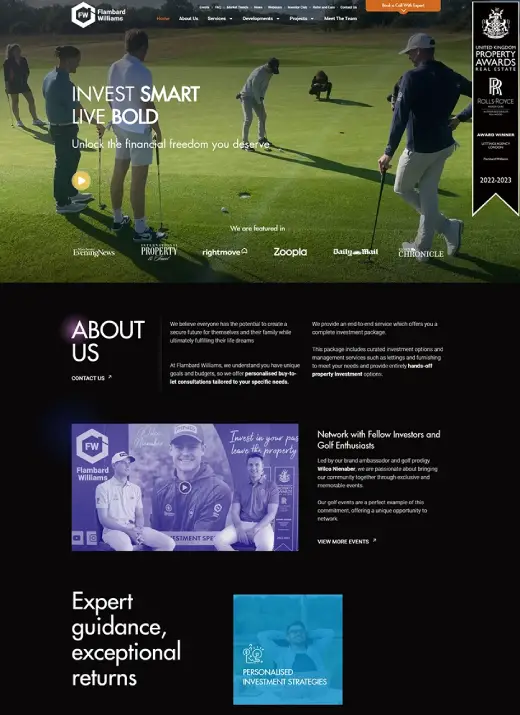

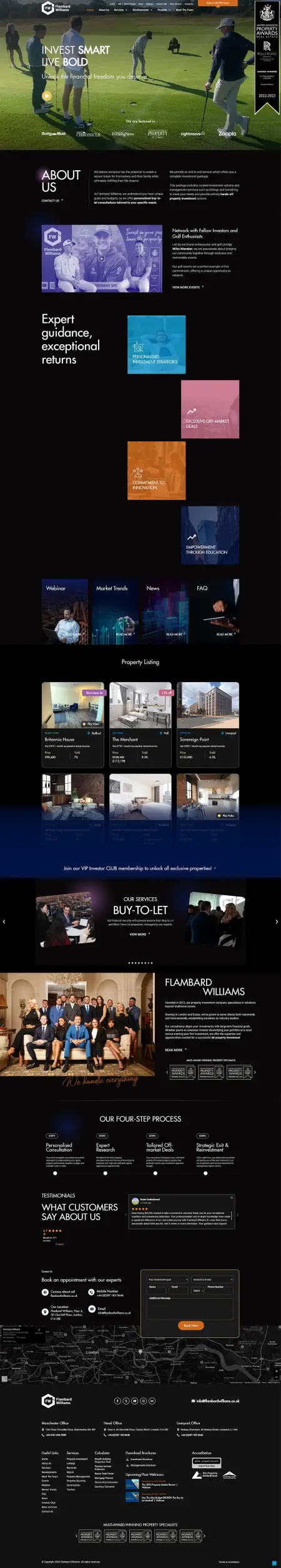

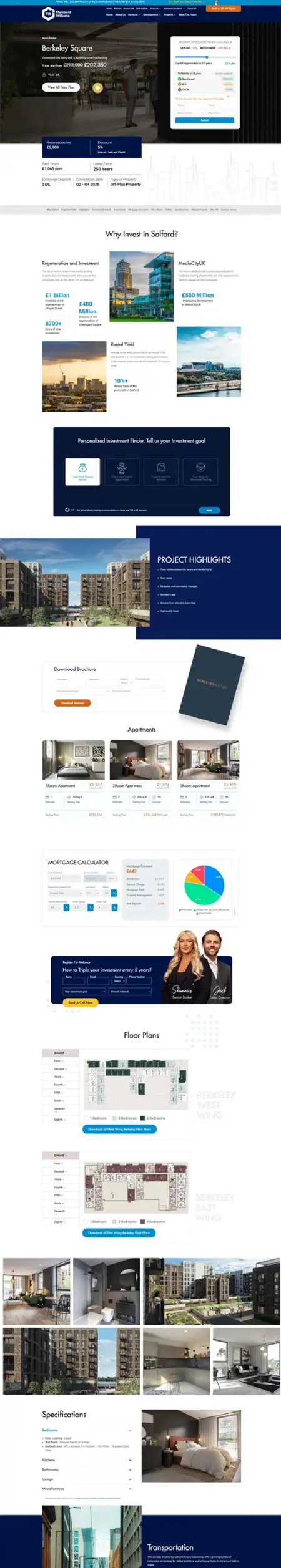

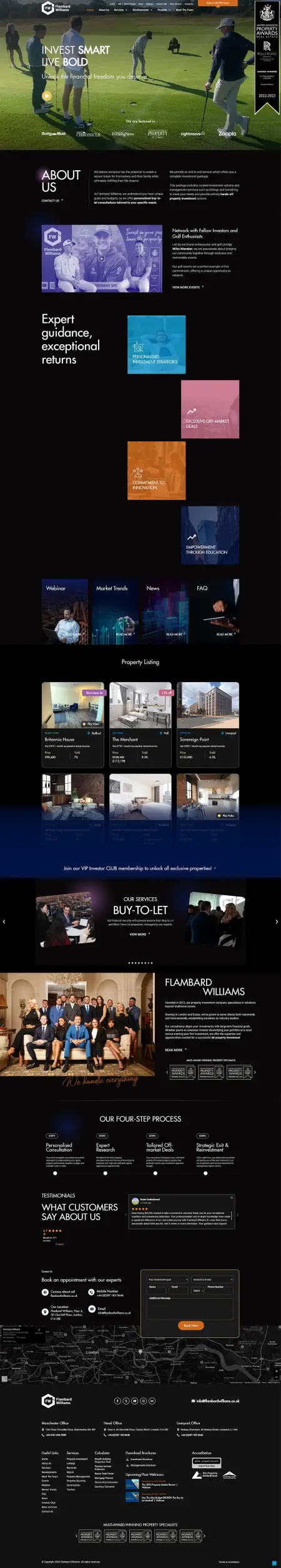

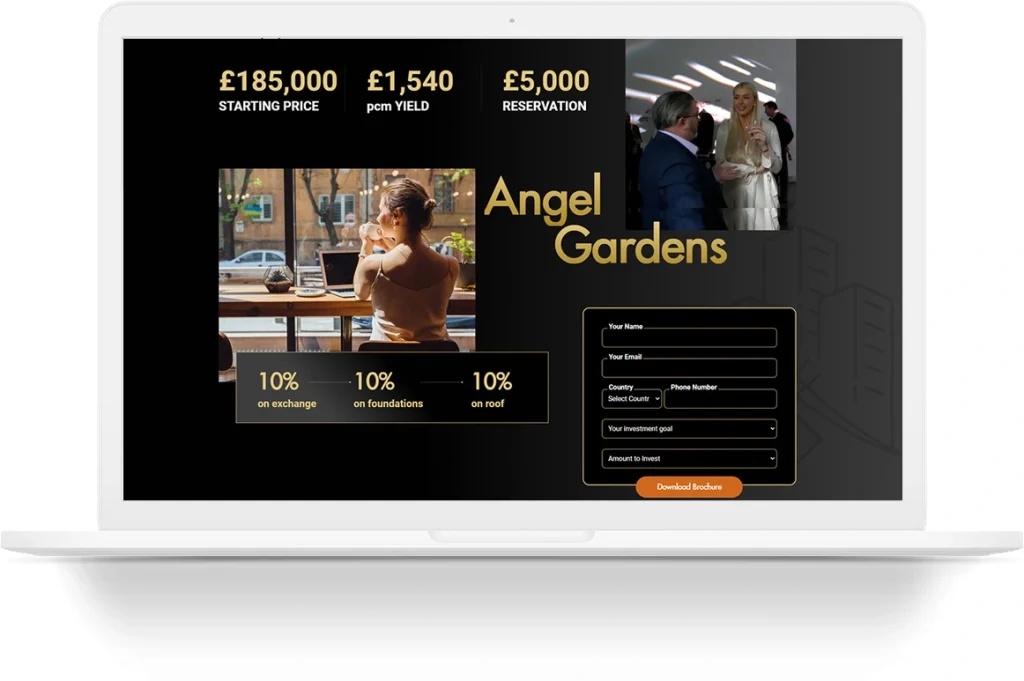

Separate landing page for different businesses

Our Design Process

Soul of web design

iscoverY

12 Hours Call

12 Days

WHO

WHAT

WHY

SMART GOAL

1 year

Grow Revenue by 200%

5 years

Grow Revenue by 500%

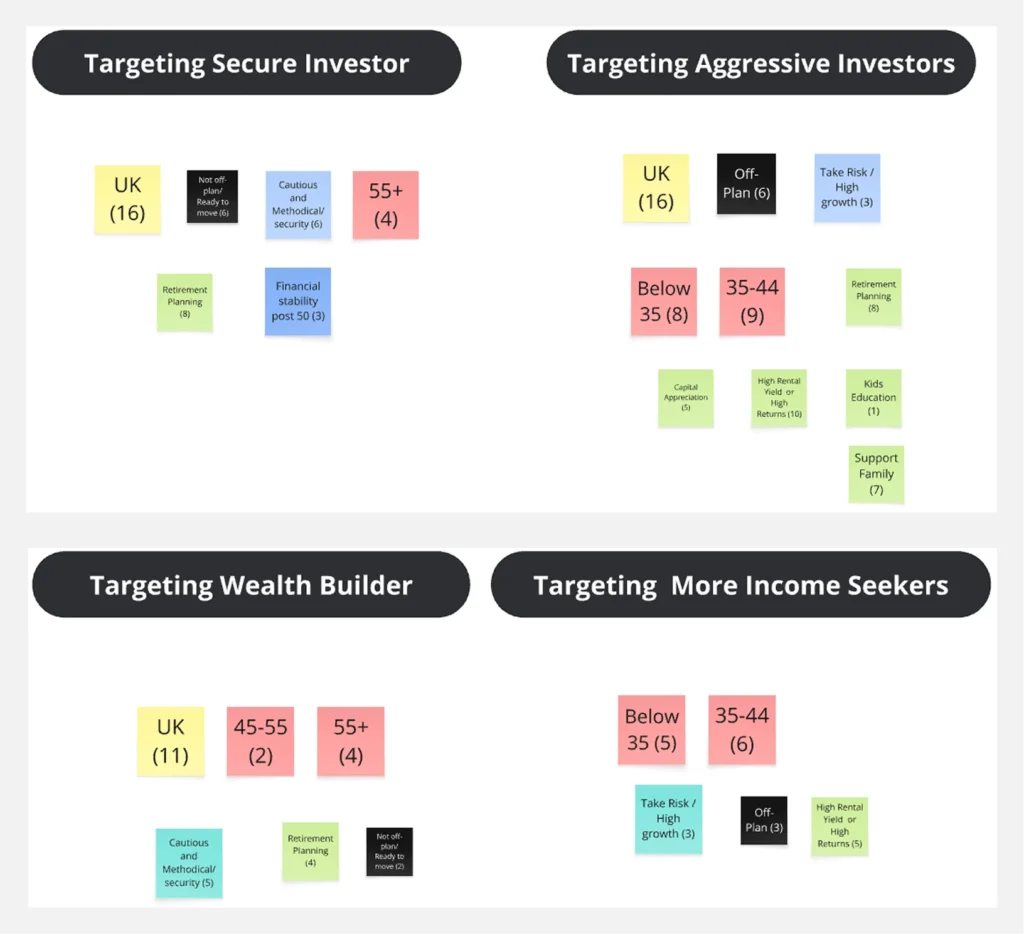

TARGET

AUDIENCE

property investors

100%

Aggressive

Secured

Wealth Builder

Passive Income Seakers

Retirement

First Time Investors

50%

Experienced Investors

50%

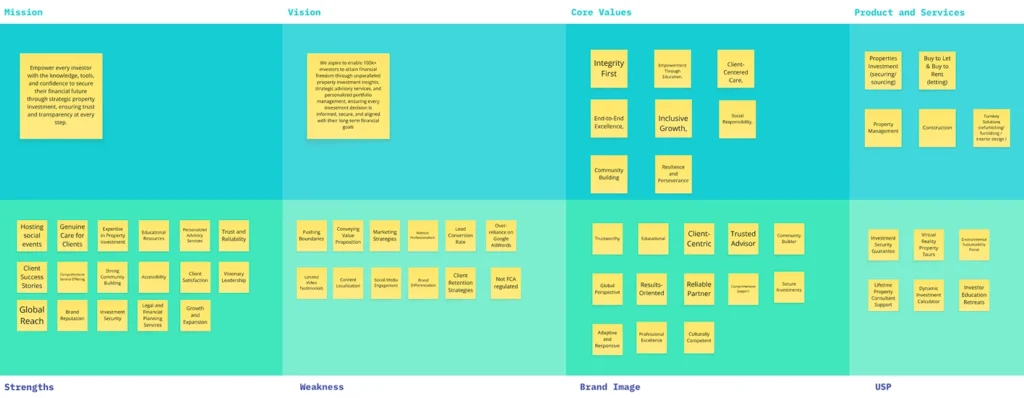

Christopher Whetstone, managing director of Flambard Williams, began his career seeking success in London’s stock market. However, a yearning for a more client-centric path led him to the property sector in 2003.

Content Discovery

Design Discovery

Marketing Discovery

Redesign Discovery

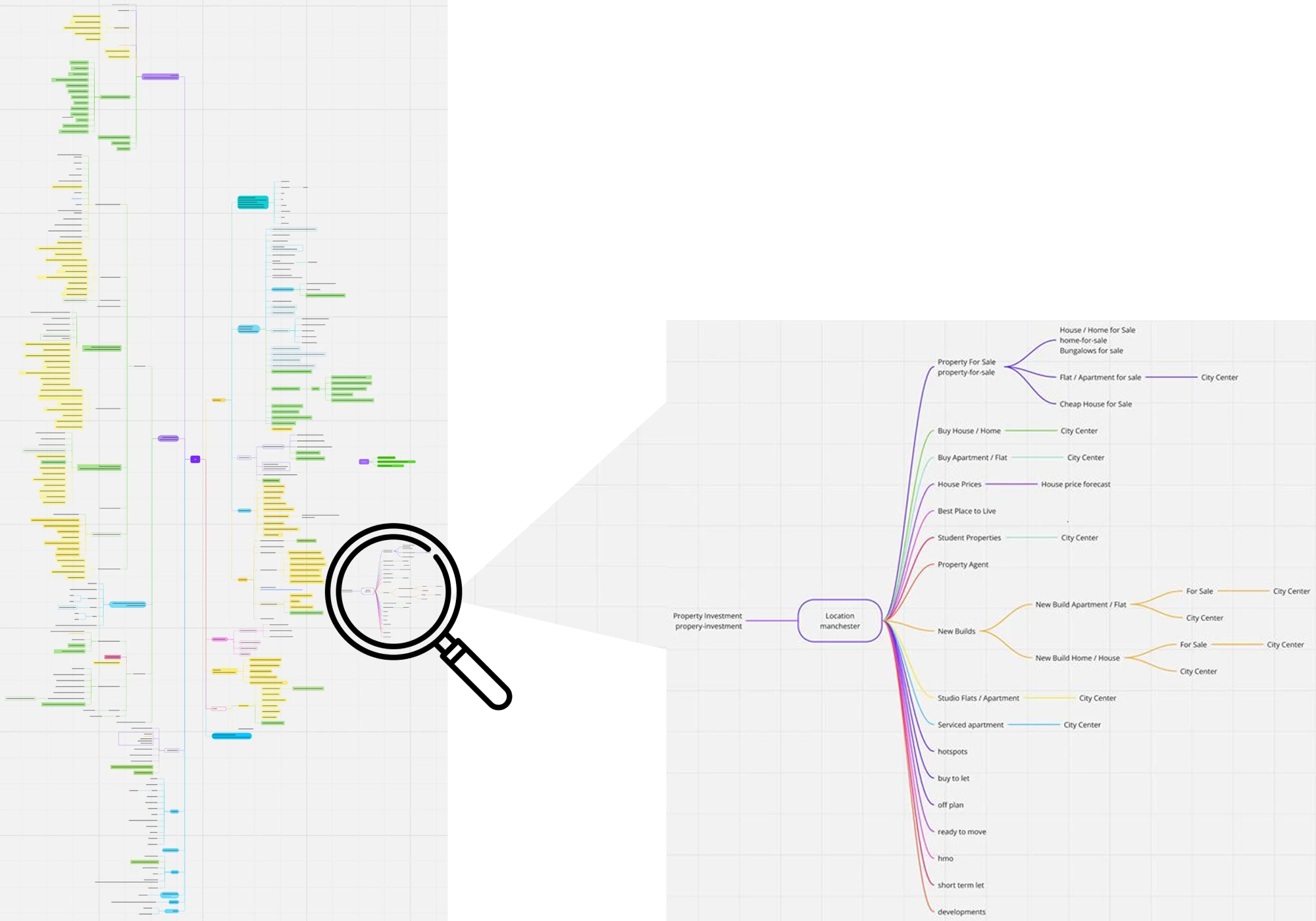

SEO

Discovery

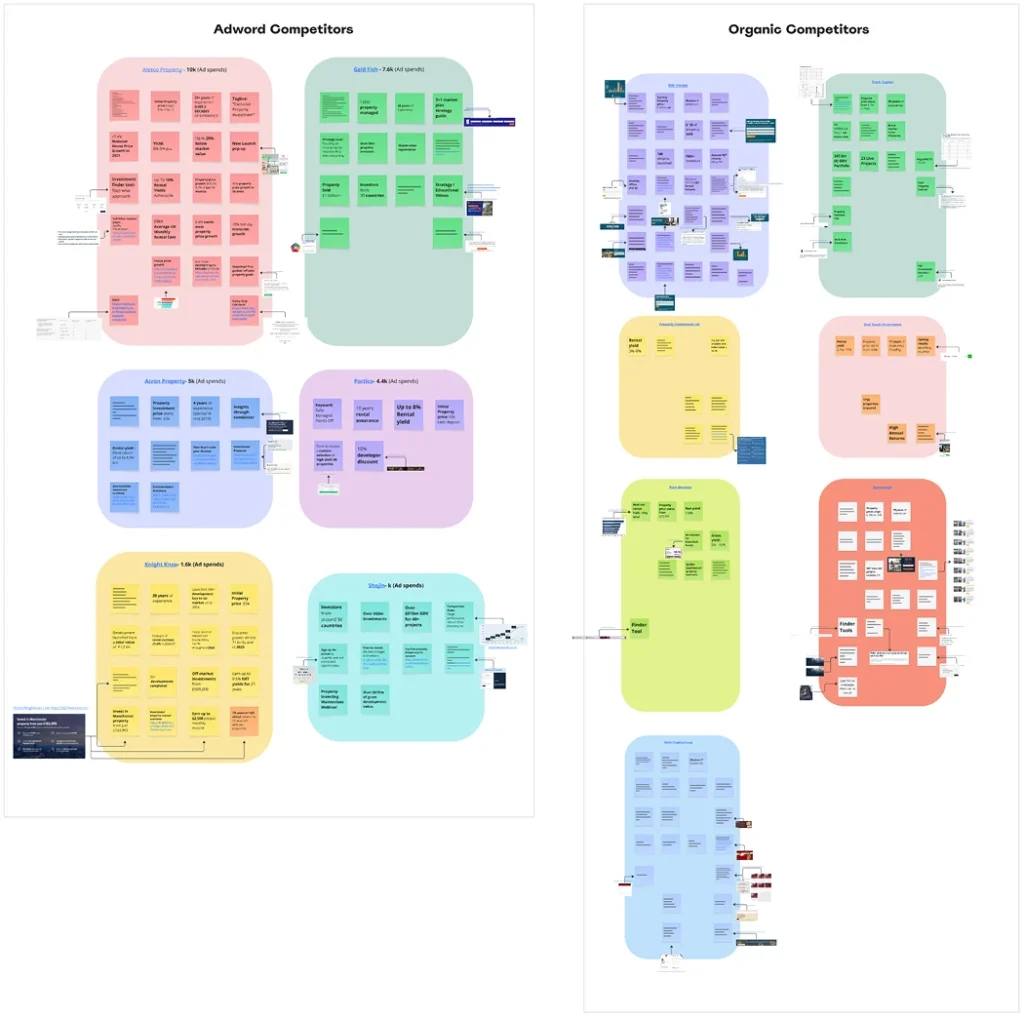

esearch

400 Hours

30 Days

user

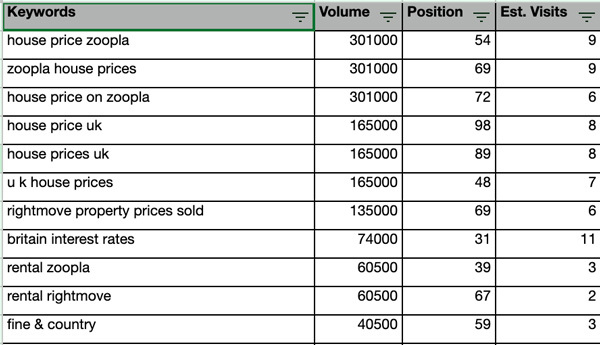

KEYWORDS

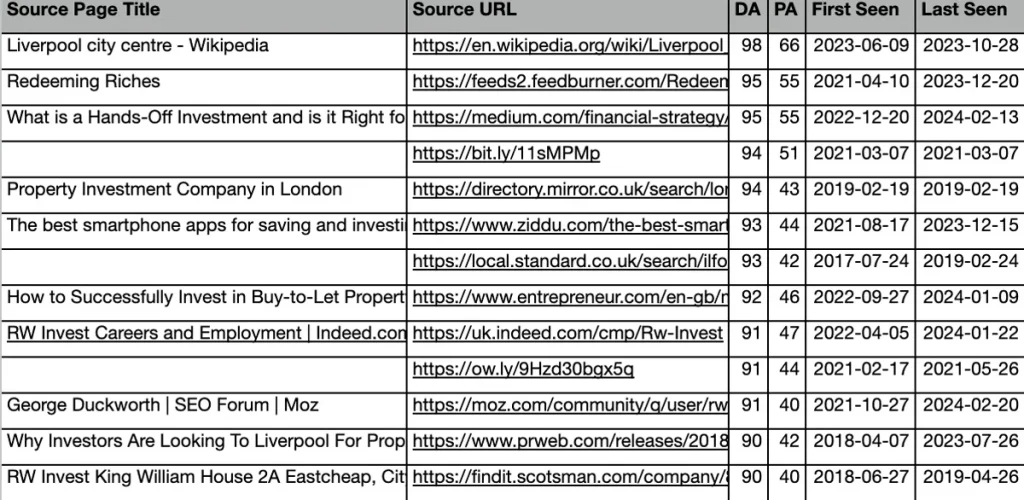

competitors

Market

Organic

Paid

USER QUESTION

Property Investors

What is the best type of property investment for someone just starting out?

Which locations are currently offering the highest rental yields?

What financing options are available for property investors, and which is most suitable?

How can I stay updated on the latest property market trends?

How do off-market property deals benefit investors, and how can I access them?

Should I focus on long-term rental properties or short-term vacation rentals for higher returns?

What are the best practices for managing properties to ensure profitability?

What tax incentives are available for property investors?

Are eco-friendly properties a better investment option in the current market?

How can I scale my property investment portfolio effectively over time?

COMMERCIAL

What are the fastest-growing sectors to maximize short-term returns?

How can I identify high-risk opportunities with the potential for exceptional returns?

What are the best strategies for flipping investments quickly for profit?

What types of investments provide the most consistent and secure returns?

How do I ensure my properties attract reliable, long-term tenants?

What strategies reduce risk while maintaining steady income?

Are properties with multiple uses better for building long-term wealth?

What are the key trends in the market that support sustained portfolio growth?

Are there properties with guaranteed lease agreements that ensure regular cash flow?

What property types offer the best long-term stability for retirement planning?

Book a FREE Strategy Session to see how we can help your business DOUBLE its revenue!

User Persona

Secured Retirement Income

John Mitchell

“A happy family is heaven on earth”

About

55 years old, male, married with 2 adult children, earns £320k/year, works as a Senior Vice President at a tech company. Lives in a suburban area, enjoys a stable and comfortable lifestyle with a focus on family and long-term retirement planning.

Needs

Retirement Planning (80%): Ensuring a comfortable and secure retirement through steady and reliable investments.

Portfolio Growth (20%): Building a diverse portfolio of ready-to-move-in properties to ensure stable income and mitigate risks.

Financial Security: Prioritizing low-risk investments to provide consistent returns and safeguard his family's financial future.

Long-term Planning: Focused on strategic investments that align with his goal of long-term financial stability.

Pain Point

Lacks knowledge of what is happening in the property market at the moment.

Concerns about managing properties, preferring low-management investments.

Difficulty understanding the legal and tax implications of property investments.

Finding reliable property management services to handle day-to-day operations and tenant issues.

Market volatility and economic uncertainties affecting property values and rental yields.

Personality

Family-oriented Tech-savvy Strategic

Ambitious Luxury-loving

Cautious

Social Media

Aggressive Retirement Income

About

31 years old, single, works as a financial analyst at a large investment firm, and aiming to build a substantial retirement fund through high-risk investments. Lives in a metropolitan area, willing to take risks for long-term gains, and focused on aggressive retirement planning strategies through off-plan properties.

Needs

Retirement Planning (20%): Building a significant retirement fund to ensure financial stability in the future.

Capital Appreciation (80%): Investing in properties that offer the potential for substantial capital appreciation.

Long-Term Financial Security: Ensuring she has enough funds to live comfortably after retirement.

High Risk, High Reward: Willing to take on riskier investments for the chance of higher returns.

Pain Point

Market Volatility: The unpredictable nature of property markets and the potential for loss.

Long-Term Commitment: The time required for off-plan properties to be completed.

Complex Decision-Making: Navigating the complexities of high-risk investments.

Financial Management: Balancing high-risk investments with her current financial responsibilities.

Finding Reliable Developers: Ensuring she invests in off-plan properties from trustworthy developers.

Personality

Risk-Taking Analytical Proactive

Innovative Growth-Oriented

Visionary

Social Media

Sarah Jenkins

“Goal without a plan is just a wish”

Swot Analysis

Strengths

- Recognised for its deep market expertise in buy-to-let properties, especially in regeneration zones like Liverpool and Manchester.

- Strong partnerships with trusted developers to provide exclusive deals at below-market prices.

- Emphasis on completed developments ensures quicker returns for investors.

Weakness

- Heavy focus on northern UK cities may miss opportunities in southern and international markets.

- Limited diversification in property types, with a primary focus on buy-to-let investments.

- Some investors may find the reliance on off-plan properties too risky.

Opportunities

- Expansion into luxury properties and premium commercial spaces to attract high-net-worth clients.

- Leveraging its established reputation to create property crowdfunding opportunities.

- Building an app to allow real-time tracking of property developments and investment updates.

Threats

- Increased regulatory scrutiny on buy-to-let investments could affect long-term returns.

- Competitors with a wider geographic presence may lure investors seeking global opportunities.

- Rising construction costs could reduce the profitability of off-plan deals.

Strengths

- A well-rounded platform offering educational resources and free training for aspiring investors.

- Strong focus on landlord-friendly, high-yield properties with potential for rapid returns.

- Long-standing trust with clients due to transparent and ethical practices.

Weakness

- Heavy reliance on educational content rather than direct, transaction-focused services.

- Limited specialisation in luxury or high-value developments, catering more to entry-level investors.

- No proprietary digital tools for managing investments or portfolio tracking.

Opportunities

- Expanding property types to include short-term rentals and serviced accommodation investments.

- Hosting virtual seminars and webinars to attract a global audience of property enthusiasts.

- Partnering with real estate tech startups to build an online marketplace for property sales.

Threats

- Competitors offering similar free resources could dilute its unique value proposition.

- Economic downturns reducing investor appetite for buy-to-let investments.

- Technological disruption from AI-driven platforms offering predictive investment insights.

Strengths

- Offers a diversified portfolio of properties across the UK and Dubai, catering to a global clientele.

- No hidden fees or additional sourcing costs, making its service highly cost-effective.

- Rigorous due diligence ensures investors have access to secure, vetted properties.

Weakness

- Over-reliance on the buy-to-let and off-plan property segments, limiting scope for diversification.

- Minimal emphasis on domestic-only investors, which could alienate those not looking for international opportunities.

- Lack of visibility in smaller UK property markets outside major cities like London and Manchester.

Opportunities

- Developing eco-friendly property investments to attract sustainability-focused investors.

- Expanding their reach in fast-growing regions like Southeast Asia or Europe.

- Offering portfolio diversification advice for seasoned investors to maximise returns.

Threats

- Rising geopolitical risks in international markets like Dubai could deter investors.

- Competition from global property firms offering similar no-fee structures.

- Fluctuations in foreign exchange rates impacting international property investments.

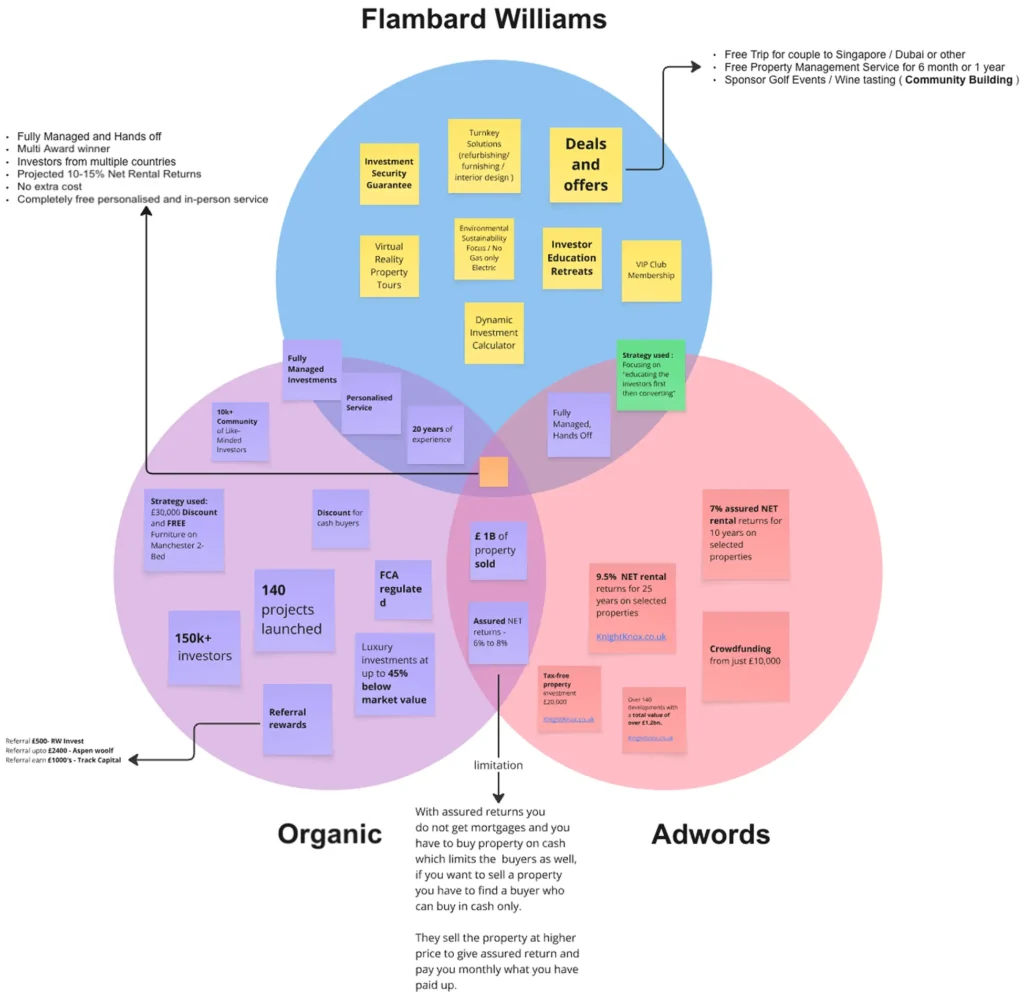

Strengths

- Personalised consultation for tailored property investment solutions.

- Expertise in identifying high net yield and capital appreciation opportunities.

- Strong emphasis on off-market properties for exclusive investments.

- Strategic investment exit planning for maximising returns.

Weakness

- [Hidden]

- [Hidden]

Opportunities

- [Hidden]

- [Hidden]

- [Hidden]

Threats

- [Hidden]

- [Hidden]

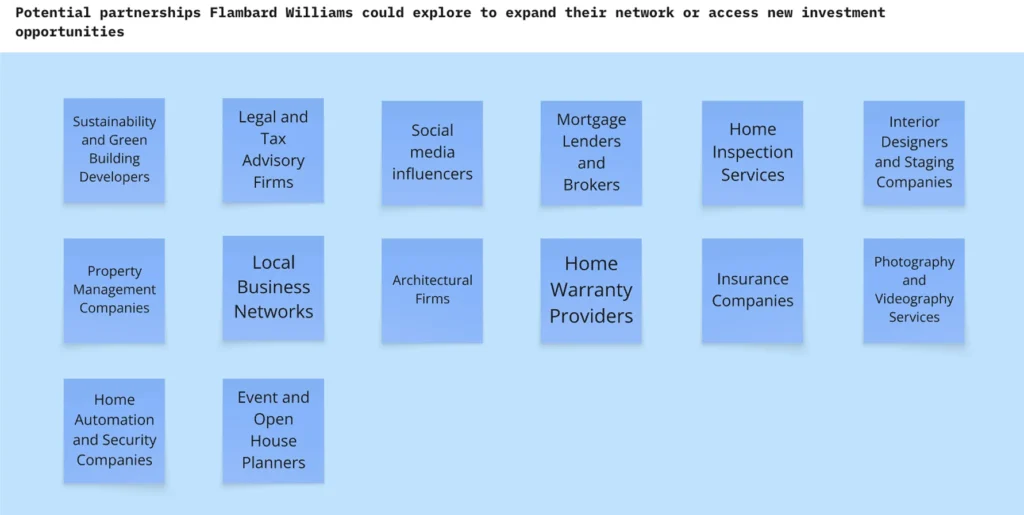

trategy

400 Hours

25 Days

Growth

Design

Content

Information Architecture

Book a FREE Strategy Session to see how we can help your business DOUBLE its revenue!

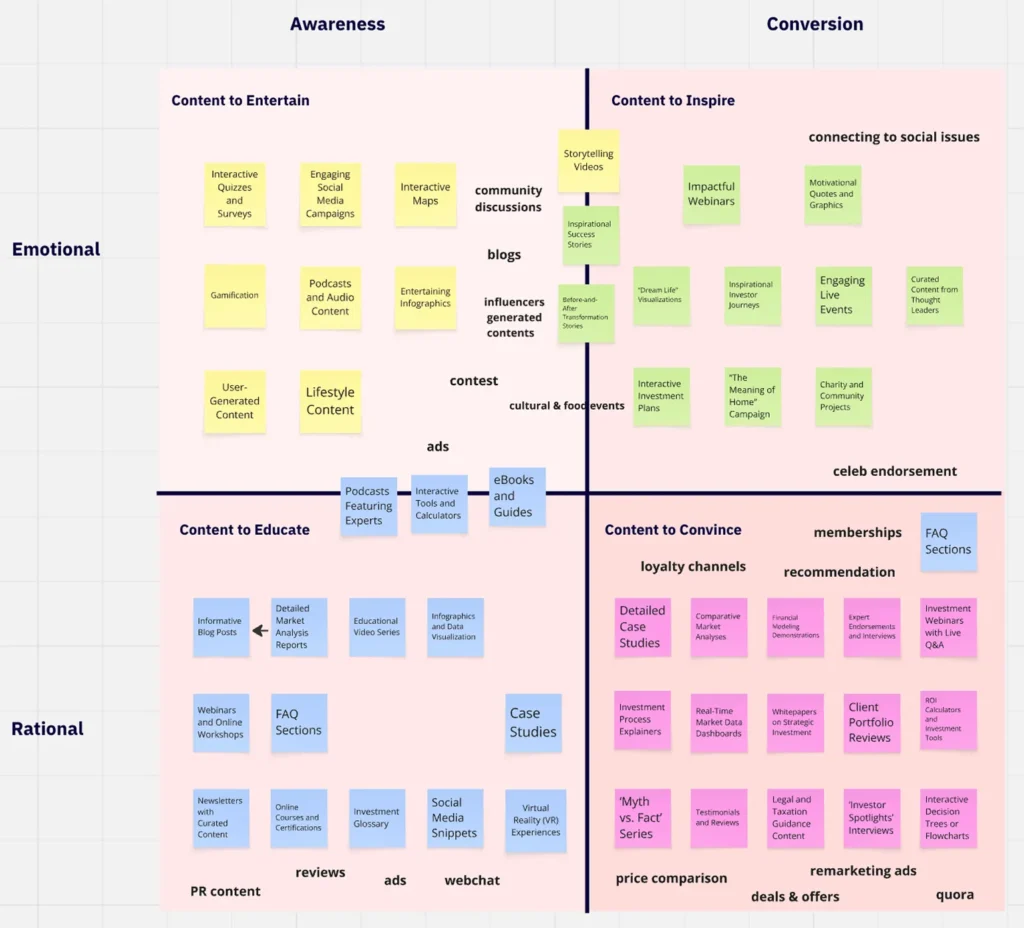

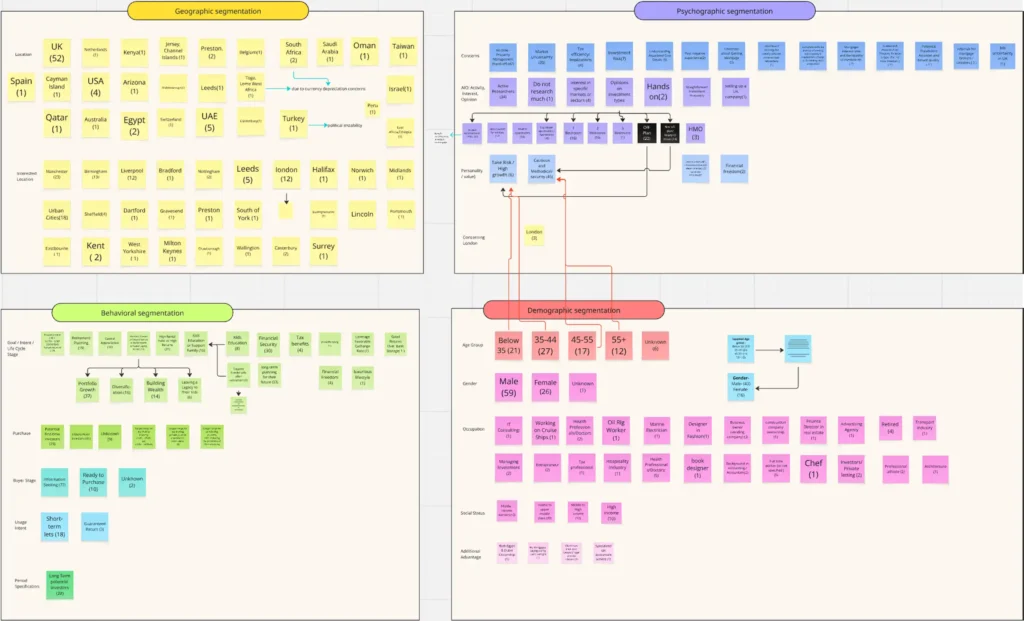

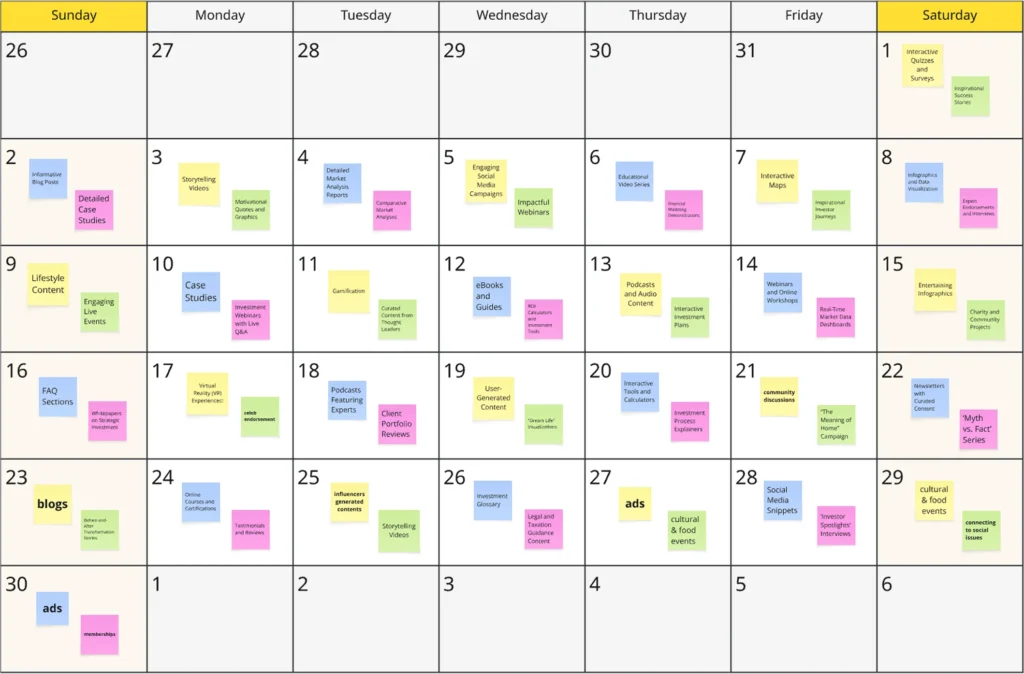

segmentation

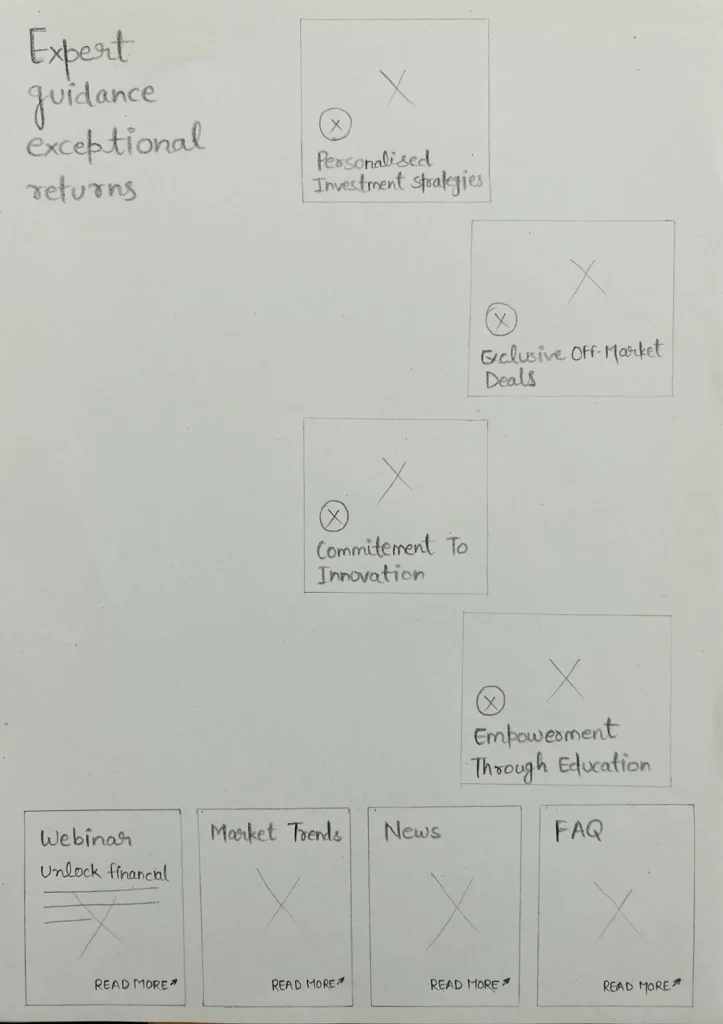

Low FI wire frame

High FI wireframe

Growth

Stratergy

UVP

Book a FREE Strategy Session to see how we can help your business DOUBLE its revenue!

Messaging Statement

Invest Smart. Live Bold.

Unlock the financial freedom you deserve.

Elivator Pitch

Flambard vision to empower 100k property investors to achieve financial freedom through secure and strategic property investments. With exclusive offerings like an investment security guarantee, immersive virtual reality property tours, luxury cum educational retreats, hand-off property management. We guide our clients toward maximizing returns and building a solid financial future in the UK property market.

did

you

know

90% of millionaires globally have made their fortunes, at least in part, through property investment.

Growth

Plan

SEO

Strategy

Marketing

Strategy

Visual design

Colors & Typography

Futura

ABCDEFGHIJKLMNOPQRSTUVWXYS

abcdefghijklmnopqrstuvwxyz

1234567890!@#$%^&*()_+{}:”|<>?,./;’\[]-=

001345

d0681d

008cca

459C77

E3CA82

E3CA82

9B5FA3

IconS used

Start the Project to grow your bottomline

We are really excited and raving to help you grow your businesses with a fully functional, aesthetically pleasing, easily navigated, user-friendly and fully responsive website.

Why wait any longer?