How to Create a User Persona (with a Real-World Example)

Crafting User Persona

Table of Contents

Serious about growing your business? Let’s plan exactly how to get you more leads, sales, and results—faster.

If your marketing feels like it’s missing the mark — there’s a good chance you don’t truly know who you’re speaking to.

We’ve seen it time and time again: great businesses, like yours, creating great offers… but targeting the wrong people, or speaking to everyone at once.

The result?

Confused messaging. Poor conversions. Wasted spending.

That’s where user personas come in.

Digital Marketing, SEO & PPC

- SEO to boost rankings and capture high-intent, AI-driven traffic

- Performance Marketing to run ROI-focused campaigns that convert

- Content Marketing to drive clicks, earn links, and build authority

So, What is a User Persona Exactly?

A user persona is a semi-fictional profile that represents a key segment of your target audience.

It’s not just basic demographics like age or job title.

A strong persona digs deeper into real goals, pain points, decision-making behaviours, and even emotional drivers.

Think of it as a character sheet for your ideal customer — based on real data, real conversations, and actual buying behaviour.

But how can you actually create a user persona that reflects your real ideal target audience?

Below I’ve compiled some simple steps to help you get started!

- How to build one from scratch

- Show you a real-world example we created for a property investment client, and

- Help you apply the same approach to your own business.

So that you too can create user personas and craft copy and design in a personalised, emotionally resonant way that speaks directly to your audience.

Let’s get into it.

How You Can Create a User Persona: Step-by-Step Process

Creating a User Persona Step 1: Start with Real Research

Before you even think about building a user persona, you need to truly know your audience. That doesn’t mean guessing based on assumptions or gut feelings. It means grounding your insights in real data.

Here’s how to start:

- One-on-one interviews with prospects or clients

- Surveys and feedback forms

- CRM and analytics data

- Social listening

- Even combing through competitor reviews

One of the most powerful things you can do at this stage?

Ask clear, intentional questions — and actually listen.

These conversations reveal what no spreadsheet can: real motivations, fears, and needs.

Not Sure What to Ask? Start Here:

Here are four foundational questions we use to uncover key audience traits — whether they lean cautious or aggressive in their investment style:

- What’s your main goal for investing in property right now — income, retirement, growth, or something else?

- How do you typically research and evaluate a new investment opportunity?

- What concerns or fears do you have about investing in real estate?

- How hands-on do you like to be when it comes to managing your investments?

- Are you more motivated by passive income, capital appreciation, or a mix of both? Why?

There are many more questions we ask to understand the whole characteristics and nature of the investors.

Want our complete list of high-converting user research questions?

We’ll help you craft your own custom questionnaire based on your ideal audience.

Creating a User Persona Step 2: Spot the Patterns and Segment

Once you’ve gathered your data, you’ll start noticing some clear patterns. Maybe certain goals keep coming up. Or similar fears. That’s your cue to start grouping.

Ask yourself:

- What goals keep popping up?

- Are there common fears or objections?

- Any shared habits, lifestyles, or tech preferences?

Let me give you a real example.

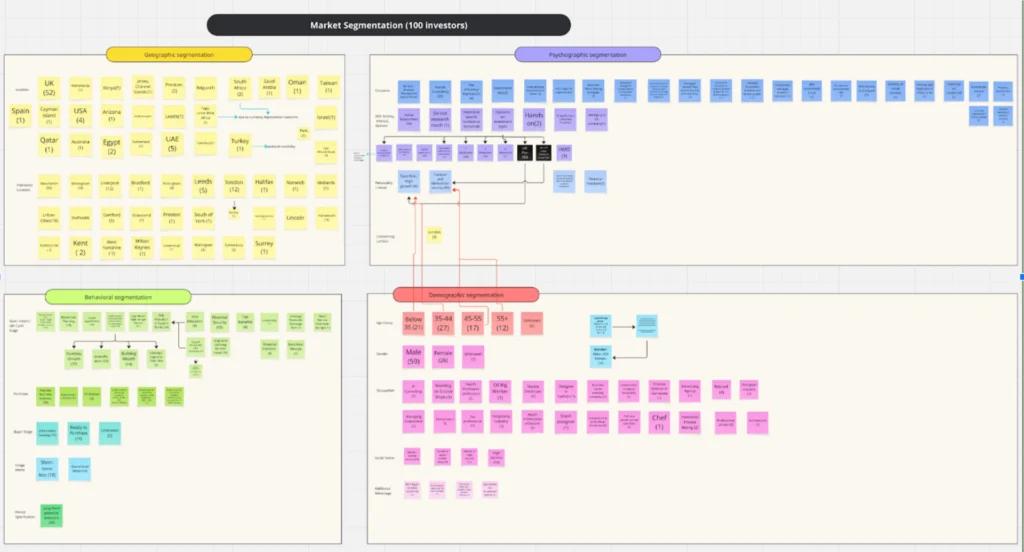

This is for the same UK-based client. After speaking to over 100 investors, we started with market segmentation — grouping leads by geography, lifestyle (psychographics), behaviour, and demographics.

Now, you all know that segmentation isn’t something you do once and forget about. It’s a process. You’ve got to keep spotting patterns in your audience to refine how you group and target them.

So, we drilled down even further, sorting them by nature.

Here’s how that broke down:

- Secured passive income investors

- Secured wealth builders

- Aggressive passive income investors

- Aggressive wealth builders

Unleash Our Exclusive In-Depth Market Segmentation Chart

Creating a User Persona Step 3: Bring Your Personas to Life

Now it’s time to put some personality into those segments. You’re going to create a detailed profile for each one.

Here’s what to include:

- Name, age, occupation, income, location

- Their goals, pain points, motivations, and blockers

- Core values and beliefs

- Which social media channels they hang out on

- Their relationship with tech

- A snapshot of a day in their life

Create a little backstory or scenario that captures their mindset.

For example, remember those four investor types? We built a full persona for each.

Let me show you two:

- One for a Secure Passive Income Earner

- And another for an Aggressive Wealth Builder

- Age : 55

- Location : Suburban commuter town

- Occupation : Senior Accountant, Financial Services

- Annual Income : $120,000

- Location : Central London (or Dubai Marina)

- Family : Married, two children

- Primary Goal : Build a secure and self-sustaining retirement income

- Investment Approach : Low-risk, stable, income-producing properties

Profile Summary

David is a numbers man. After 30+ years in finance, he’s meticulous, conservative, and allergic to financial surprises. Now approaching retirement, he’s not chasing big wins—he’s chasing peace of mind. He wants a reliable stream of passive income that complements his pension and lets him enjoy life without money stress.

Key goals

- Generate predictable passive income from turnkey rental properties

- Build a bulletproof retirement plan with long-term stability

- Ensure financial support for his wife and eventual inheritance for his children

Pain Points

- Doesn’t trust “get rich quick” schemes or unstable property types

- Lacks time to manage properties hands-on due to his demanding job

- Struggles to stay updated with property trends in a rapidly shifting market

- Finds sourcing trustworthy property managers and vetted investments a chore

Motivators

- Stability over speed: prefers steady 6% yields over speculative returns

- Financial clarity: wants transparent, hands-off investment vehicles

- Family-first: Providing a safety net for his loved ones drives his decisions

- Professional pride: wants his portfolio to reflect the same diligence and order he applies to his career

Fill the form to access the full profile.

Demotivates

- High-risk investments: Fear of losing capital and jeopardizing his financial security.

- Complex investment processes: Prefers straightforward and transparent investment options.

- Market instability: Concerns over economic fluctuations impacting property values and rental income.

- High maintenance and management costs: Avoid properties that require extensive management or incur high ongoing costs.

- Unreliable tenants: Stress and financial strain caused by dealing with problematic tenants.

Behaviours

- Spends weekends reading investment newsletters or watching finance-focused YouTube channels

- Attends webinars or virtual open houses instead of traveling for viewings

- Relies heavily on spreadsheets, property dashboards, and advisors

- Responds to email campaigns that include case studies, calculators, or retirement ROI models

Interests

- Reading financial news and updates: Staying informed about market trends and investment opportunities.

- Traveling with his wife: Enjoying leisure time and exploring new destinations.

- Community involvement: Participating in local events and supporting community initiatives.

- Hobbies: Golf, gardening, and spending quality time with family and friends.

- Attending investment seminars: Learning more about secure and profitable investment strategies.

Desires

- Achieve financial independence: Relying on passive income to cover living expenses and enjoy retirement.

- Build a diversified investment portfolio: Including various low-risk, high-yield properties.

- Leave a legacy: Ensuring financial stability for his children and future generations.

- Maintain a comfortable lifestyle: Having sufficient income to enjoy his current lifestyle without financial strain.

- Simplify investment management: Using efficient property management services to minimise involvement.

Aspirations

- Achieve a high level of financial security: Ensuring a stable and secure future.

- Create a sustainable income stream: Building a portfolio that generates reliable passive income.

- Retire comfortably: Enjoying a stress-free retirement with adequate financial resources.

- Leave a financial legacy: Providing for his family and ensuring their financial well-being.

- Become a mentor: Share his knowledge and experience with others interested in property investment.

Values

- Stability and security: Prioritises low-risk investments and financial stability.

- Integrity and honesty: Values transparency and ethical practices in his investments.

- Family well-being: Focused on ensuring financial security for his loved ones.

- Responsibility and diligence: Meticulous in managing his investments and making informed decisions.

- Continuous improvement: Committed to lifelong learning and personal growth.

What are his preferred channels of communication?

- Email newsletters: Subscribes to financial and real estate updates.

- Webinars and online courses: Participates in virtual learning sessions on property investment.

- Financial magazines and journals: Reads publications for in-depth analysis and market insights.

- Personal consultations: Engages with financial advisors and real estate agents for personalized advice.

- Community forums: Participates in discussions with other investors to share knowledge and experiences.

What technology would he use?

- Financial management apps: For tracking income, expenses, and investment performance.

- Property management platforms: For efficient handling of rental properties and tenant interactions.

- Automated market analysis tools: To stay updated on property values and rental yields.

- Virtual property tours: To evaluate properties remotely before making investment decisions.

- Online investment platforms: For researching and purchasing real estate investments.

A Day in His Life:

Morning:

- Starts his day with a review of his investment portfolio and financial news over breakfast.

- Enjoys a morning walk or light exercise with his wife.

Mid-Morning:

- Heads to work, focusing on his responsibilities as a Senior Accountant.

- Takes a break to check emails and review property management updates.

Afternoon:

- Lunch with a colleague or financial advisor to discuss market trends and investment opportunities.

- Research potential ready-to-move-in properties online.

Evening:

- Attends a webinar on secure property investment strategies.

- Reviews and evaluates property listings, making notes on potential investments.

Night:

- Relaxes by reading a book or watching a documentary on finance and investments.

- Discusses future investment plans and retirement goals with his wife before bed.

Age

45

Location

Suburban Area

Occupation

Tech Startup Founder

Annual Income

$250,000+

Location

Central London (or Dubai Marina)

Family

Married with 3 children

Primary Goal

Fast-track wealth creation through high-growth property investments

Investment Approach

Bold, fast-moving, opportunistic

Profile Summary

Mark moves fast and thinks big. As a founder in the tech space, he’s used to managing volatility and winning from it. He views property as an extension of his entrepreneurial drive: not just an asset class, but a wealth acceleration tool. He’s all-in on off-plan, undervalued, or emerging market properties—if the upside is massive.

Key goals

- Rapid capital appreciation from off-plan or emerging market opportunities

- Build a high-performing, high-growth real estate portfolio

- Diversify his wealth across asset classes to safeguard against tech volatility

- Achieve financial freedom by 50

Pain Points?

- Wary of long project delays in off-plan property

- Doesn’t want to be bogged down by micromanaging properties

- Often too busy to deep-dive into every deal himself

- Needs trustworthy data and deal flow from elite property consultants

Motivators

- High ROI and the thrill of identifying “undervalued gems”

- Flexibility: investments that align with his high-speed lifestyle

- Social proof: being seen as a savvy investor among peers and family

- Long-term play: leaving a financial dynasty for his children

Fill the form to access the full profile.

Demotivators

- Low returns: Disinterested in investments that offer low returns or stable but lower earnings.

- Avoids high supervision properties: Prefers investments that do not require his constant attention.

- High maintenance properties: Avoids investments that require high maintenance or are in high-risk areas.

Interests

- Technology: Interested in tech and innovation, always looking for ways to integrate technology into his investments.

- Adventures: Enjoys exploring new opportunities and taking risks.

- Investing in his kids' future: Ensuring their financial stability and providing the best for them.

- Living an adventurous lifestyle: Incorporating high-risk investments to support his lifestyle.

- Gains inspiration from success stories: Always looking for successful investors to inspire him.

Desires

- High returns on investments: Looking to turn his investments into wealth.

- Financial legacy: Leaving a legacy of wealth for his children.

- Luxurious lifestyle: Achieving a lifestyle that allows him to provide the best for his family.

- Invest in high-growth projects: Always looking for projects that could give high returns.

- Balanced work and investments: He wants to balance his business and investments.

Behaviours

- Reviews properties and performance dashboards on the go via mobile apps

- Has a network of investment advisors and developer contacts

- Follow influencers, developers, and investor communities on LinkedIn, Threads, and X

- Responds best to bold, data-driven pitch decks and investment teasers with strong upside

Aspirations

- Achieve financial independence: Ensuring he can provide a comfortable future for his family.

- Build a wealth portfolio.

- Building a portfolio that reflects his investment philosophy.

- Inspire others: Encourage others to take risks and invest in high-return properties.

- Leave a legacy: Leave a financial legacy that his family can be proud of.

- Secure a luxurious future: Ensuring a comfortable and luxurious future.

Values

- Risk-taking: Believing that taking risks is the key to success.

- Family first: Making decisions with his family’s future in mind.

- Integrity: Maintaining integrity and honesty in all his ventures.

- Continuous improvement: Always looking for ways to improve his investments.

- Success: Driving his investments to success.

What are his preferred channels of communication?

- Online platforms: Using platforms to stay updated on market trends.

- Investor networks: Gaining insights and tips from other investors.

- Direct communication: With investment advisors and property developers.

- Social media: Using social media to stay informed about potential investments.

- Investing apps: Using apps to track his investments.

What technology would he use?

- Investing apps: For tracking his investments and market trends.

- Digital platforms: For real-time updates on market trends.

- Virtual tour tools: For assessing properties remotely.

- Online investment platforms: To make quick investment decisions.

- Automated tracking tools: To track his investments and their performance.

A Day in His Life:

Morning:

- Starts his day with a review of his investment portfolio and market news over breakfast.

- Sends kids off to school and heads to the office.

Mid-Morning:

- Engages in meetings and manages his startup.

- Takes a break to review potential property investments.

Afternoon:

- Lunch with a colleague or investment advisor to discuss potential investments.

- Makes decisions on off-plan properties.

Evening:

- Attends a virtual investor network meeting to get updates and insights.

- Reviews and evaluates investment proposals, making decisions on next steps.

Night:

- Spends time with family, discussing future plans.

- Ends the day with a review of his investments and latest market updates.

Prolonged completion times: Dislikes projects that extend beyond their anticipated completion time.

Marketing Research & Strategy

We help you understand your market and build smart strategies to attract more customers and grow faster.

- Detailed research into your competitors, customers, and market

- Custom marketing and growth plans that drive real results

- Clear action steps to increase traffic, leads, and sales

ADWORDS ROI

Cut Ad spend

Creating a User Persona Step 4: Test, Tweak, Improve

Personas aren’t “set it and forget it” tools. They’re working models — meant to be tested and refined.

Use A/B testing, collect feedback, and watch how your campaigns perform. If something feels off, adjust. Personas should evolve based on what’s actually happening out there.

Also READ: The UK Real Estate SEO Blueprint How to Rank #1 on Google & Generate Free Leads

Creating a User Persona Step 5: Put Them to Work

Creating personas is only half the job. The real magic happens when you use them — in your copy, campaigns, landing pages, even product decisions.

Here’s a practical example:

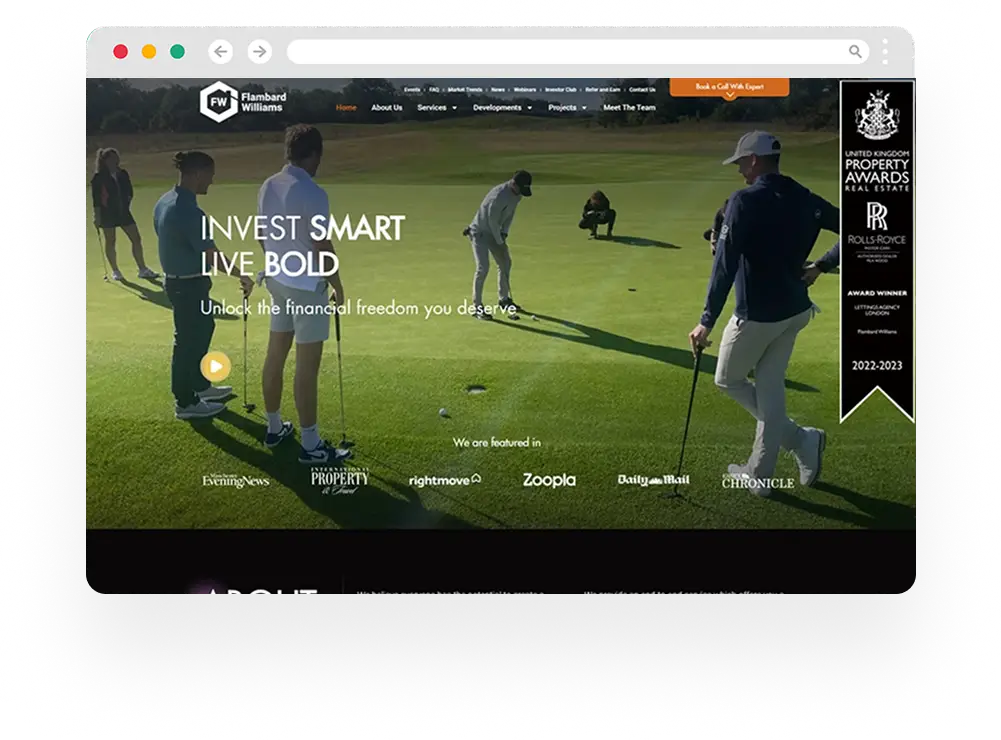

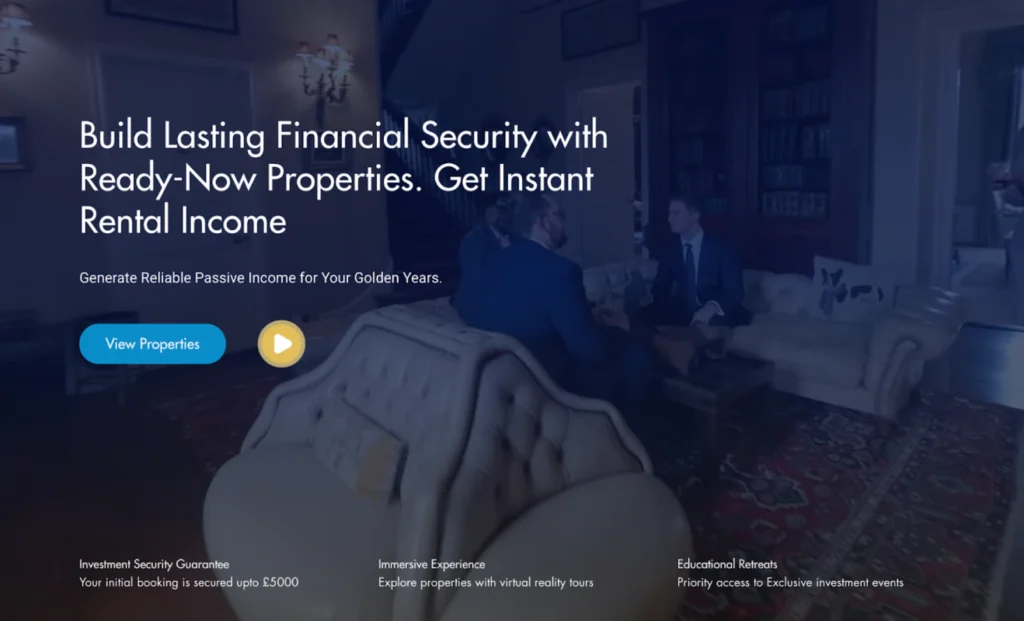

We created two different landing pages for two distinct personas (the personas mentioned above):

Each page had different messaging, tone, and CTAs, and each one spoke directly to the needs and mindset of that specific group.

Curious how we consistently drive 10X conversions and skyrocket ROI from 396% to over 1,600%?

Discover the exact process behind these results in a personalised, high-impact Strategy Session — designed to uncover hidden opportunities, fix what’s holding you back, and map out your next level of growth.

Creating a User Persona Step 6: Keep Them Fresh

People change. Markets shift. Tech evolves.

That’s why you should revisit your personas at least every quarter. Update them based on new insights, behavior shifts, or any major market changes.

Keyaway

By now, you’ve seen that building user personas isn’t just about ticking boxes on a worksheet.

It’s about truly understanding the people behind the data—their fears, goals, routines, and motivations—and using those insights to craft sharper, more relevant marketing.

From research and segmentation to building dynamic profiles and putting them into action, every step brings you closer to a real connection and better conversions.

And remember: personas aren’t static.

The smartest brands treat them as living, evolving tools—shaped by new insights, behaviours, and feedback over time.

So, whether you’re selling real estate, SaaS, or something entirely different, know your people, speak their language, and never stop learning from them.

That’s how you turn strategy into real marketing wins.

Want help building user-intent landing pages that actually convert?

Book a free 1-hour Strategy Session, where we’ll walk you through a proven framework to boost your conversions and uncover new revenue pathways.